Navigating the world of real estate in Kenya can feel like a maze, but it doesn't have to be a scary one. With the right information and a little bit of street smarts, you can confidently buy property and protect your hard-earned money. The good news is that the Ministry of Lands has made things much simpler with Ardhisasa, a digital platform that brings most of the process online.

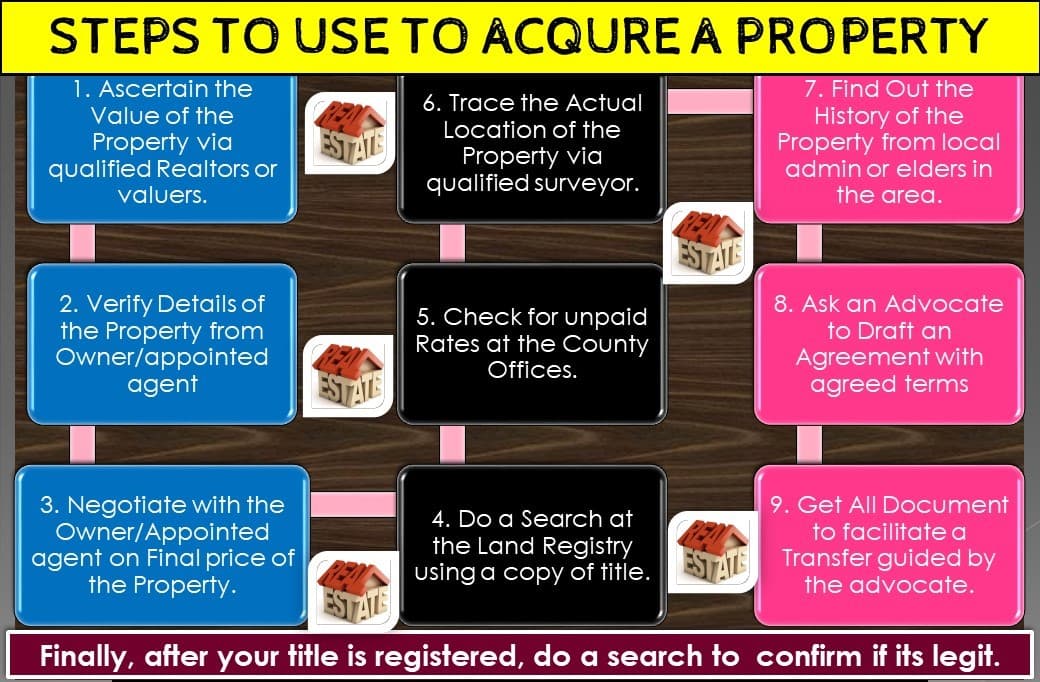

Here's a step-by-step, street-smart guide to buying property in Kenya, with updated information to reflect the Ardhisasa system.

Step 1: Know What You're Buying (and Its Value)

Before you fall in love with a property, you have to be practical. Don't just rely on photos or what the seller tells you. You must physically visit the property—at least twice! The first time, go with the seller or agent. The second time, go alone or with a trusted, independent real estate professional. This helps you confirm the location, size, and condition without pressure.

To make sure you're not overpaying, ask around. Talk to neighbors or small business owners in the area. Ask what the last piece of land sold for. This simple trick gives you a feel for the local market price, so you can negotiate from a place of strength. Remember, as the saying goes, "You make your money when you buy, not when you sell."

Step 2: Get the Details Right from the Source

Once you've found a property you like, it's time to verify everything. Talk directly with the property owner or their officially appointed agent. If it's an agent, they should show you a signed letter of authority from the owner. This simple step prevents a lot of headaches later on, as it ensures the price and terms you're being given are accurate and up-to-date.

Step 3: Negotiate and Agree on the Terms

This is a crucial step to avoid wasting time and money. Before you start the expensive due diligence process, agree with the seller on the final price and the payment terms. Standard practice in Kenya often involves a 90-day payment period, but you can agree otherwise. Also, be clear about all the costs involved, including legal and agent fees. Knowing the total cost upfront will prevent any nasty surprises and help you budget effectively.

Step 4: The Ardhisasa Revolution: The Land Search

The days of physically going to a land registry are largely over. The government's Ardhisasa platform has digitized land records, making the process faster and more secure.

Create an Ardhisasa Account: Register on the platform as an individual. You'll need your ID and a mobile number.

Request a Search: The seller will initiate an official land search on your behalf through their Ardhisasa account. This search, which costs KSh 1,000, will show you:

The true owner of the property.

Whether there are any legal restrictions (like a court order).

If the land has been used as loan security and has a charge on it.

A search through Ardhisasa is much more reliable than a manual one. It's also vital to check the seller's ID against the details in the search to ensure they're the rightful owner and not an imposter.

Step 5: Check County Rates and Fees

Properties have annual rates payable to the county government. Before you proceed with the purchase, ask the seller to provide a rates clearance certificate from the county. The seller is responsible for clearing any outstanding rates. You can also agree to pay any outstanding balance yourself, deducting it from the purchase price.

Step 6: Verify the Boundaries (Use a Surveyor!)

Don't just trust the seller's word on where the land starts and ends. It's a common mistake that can lead to buying the wrong parcel or a smaller one than advertised. Hire a registered and qualified surveyor to verify the property's boundaries using a deed plan or a cadastral map. They will locate and confirm the beacons (the corner markers) to ensure the size and location match the title deed. While a surveyor's fee varies, it's a small price to pay for peace of mind.

Step 7: Get the History from the Community

While Ardhisasa provides official data, some things are best learned from the ground. Head to the local sub-county or chief's office. Over a cup of tea, you can learn a lot from the local administrator. They can provide valuable insights into the property's history, including any family disputes or inheritance issues that may not show up on a search. This "street-smart" due diligence can save you from a legal nightmare.

Step 8: Engage a Lawyer and Sign the Agreement

A lawyer is a non-negotiable part of the process. They will draft a Sale Agreement that puts all your negotiated terms in writing. This agreement outlines the purchase price, payment schedule, and all other conditions. It's standard practice to pay an initial deposit (usually 10% of the purchase price) at this stage. The balance is paid once the title is officially in your name. Lawyers' fees are regulated by the Advocates Remuneration Order, and are typically a percentage of the property value, with a minimum fee for lower-value properties.

Step 9: Transfer the Title and Pay Taxes

This is the final stretch! The transfer process is now largely done on Ardhisasa.

Land Control Board Consent: If the land is agricultural, you'll need consent from the Land Control Board. The seller applies for this. A normal consent costs around KSh 3,000 and is done at a monthly meeting, while a special one costs KSh 10,000 or thereabout for a quicker process.

Valuation for Stamp Duty: The Ministry of Lands will conduct a valuation to determine the Stamp Duty you need to pay.

Pay Taxes: The two main taxes are:

Capital Gains Tax (CGT): This is a tax on the profit from the sale, paid by the seller. The current rate is 15% of the net gain.

Stamp Duty: This is a transfer tax paid by the buyer. The rate is 4% for properties in urban areas and 2% for agricultural land. You pay this on Ardhisasa.

Registration: Once all payments and documents are submitted, the land registrar will process the transfer and register the title in your name.

Step 10: The Final Search and Celebration!

After the transfer is complete, do a final search on Ardhisasa to confirm that the title is now officially under your name. You can even do a follow-up search a few months later to be extra cautious.

Congratulations! You are now a property owner in Kenya. By following these updated, street-smart steps, you can avoid scams and make a secure investment.