Many people believe you must earn a lot to own a home — but that’s not true.

With a Ksh. 80,000 monthly income, you can build and own a Ksh. 3.5 million simple 3-bedroom bungalow (including land) in just 5 years.

You only need a clear plan, consistency, and discipline.

Let’s see how you can make it happen.

Step 1: Know Your Goal

Your dream: a 3-bedroom bungalow worth Ksh. 3.5 million (land + construction).

That means you need to raise:

Ksh. 3,500,000 ÷ 5 years = Ksh. 700,000 per year

Ksh. 700,000 ÷ 12 months = Ksh. 58,333 per month

You don’t have to save that full amount directly from your salary — but you can reach it through consistent saving, investment, and smart financing.

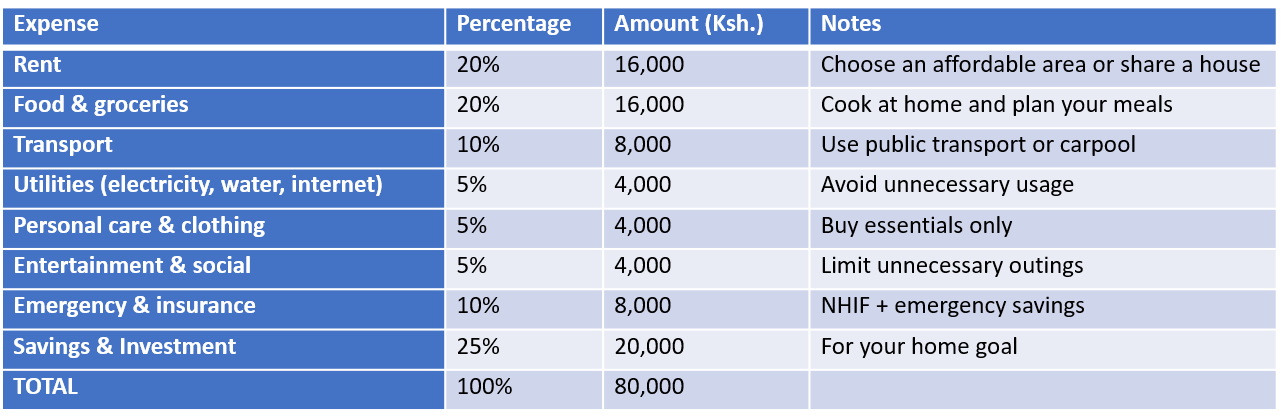

Step 2: Smart Monthly Budget for a Ksh. 80,000 Salary

Here’s a practical and realistic budget for a single person earning Ksh. 80,000:

✅ Commit to saving Ksh. 20,000 monthly.

Over 5 years, that’s Ksh. 1.2 million — and with wise investing, it can grow faster.

Step 3: Grow Your Savings Through Investment

Don’t let your money sleep in a normal savings account — make it grow!

Here are safe and smart ways to invest in Kenya:

Sacco (Savings & Credit Cooperative):

Join a trusted Sacco. You’ll earn dividends and can borrow up to 3 times your savings to buy land or start building.Money Market Fund (MMF):

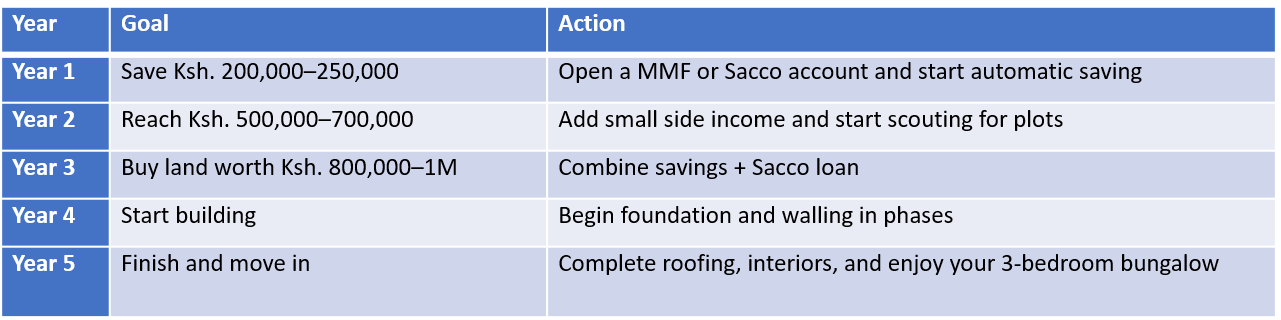

Invest your Ksh. 20,000 monthly in a MMF that pays 10–12% interest per year.

After 5 years, your Ksh. 1.2M can grow to Ksh. 1.5M or more.Side Hustle or Skill Work:

Add a small income source — freelancing, weekend jobs, or online work — and direct all extra money to your “Home Fund.”

Step 4: Adopt the Right Financial Mindset

Building a home starts in the mind before it shows on the ground.

✅ Avoid lifestyle inflation.

When you get a raise, increase your savings — not your spending.

✅ Pay yourself first.

Save before you spend on anything else.

✅ Live below your means.

Your goal is freedom, not show-off purchases.

✅ Track your expenses.

Know where every shilling goes each month.

✅ Stay motivated.

Visit land projects, visualize your house plan, and remind yourself why you started.

Step 5: Affordable Financing Options to Boost You

You don’t need all the Ksh. 3.5 million in cash. Use affordable financing to reach your goal faster:

Sacco Loan:

After saving Ksh. 500,000, borrow 3x (Ksh. 1.5M) to buy land or start construction.Micro-Mortgage or Construction Loan:

Banks like Co-op Bank, Housing Finance, and Shelter Afrique offer low-interest home loans.Incremental Building:

Buy your plot first, then build in stages — start with the foundation, then walls, then roofing.Joint Investment:

Partner with a trusted friend or sibling to buy land together, then later build individually.

Step 6: The 5-Year Action Plan

Final Thought

Owning a 3-bedroom home worth Ksh. 3.5 million isn’t about luck — it’s about planning, patience, and financial discipline.

Start today with your first Ksh. 20,000 saved, and stay consistent.

In 5 years, you’ll be walking through the doors of your very own 3-bedroom bungalow — debt-light, proud, and free.