This post explains how much it costs to move a land title into a buyer’s name in Kenya in 2025. It shows the main fees for freehold and leasehold land, the legal charges, and the documents each side must bring. I use short simple sentences so anyone can understand.

Main costs you will meet

1) Stamp duty (big tax you pay)

Urban / residential land: 4% of the value. (State Department for Lands)

Rural / agricultural land: 2% of the value. (State Department for Lands)

Some special rates apply for commercial property or special cases — always check with KRA. (Kenya Revenue Authority)

Example: If market value = KSh 1,000,000 (urban), stamp duty = 4% of 1,000,000 = KSh 40,000.

(Work: 1,000,000 × 0.04 = 40,000.)

2) Land registry / registration fees (small fixed fees)

The Lands Department charges fixed fees such as: registration opening fee (≈ KSh 1,000) and title fees (≈ KSh 2,500). The exact small fees are on the Lands service charter. (State Department for Lands)

3) Land Control Board (LCB) consent fee

If the land is agricultural or in an area controlled by the Land Control Board, you must get consent. The application fee is about KSh 1,000 (check local board). This is mandatory for many transfers. (Kenya Law)

4) Valuation & search fees

Government valuation (for stamp duty calculation) and title search fees are charged (small amounts, e.g., search fee ≈ KSh 500 and valuation fees vary).

5) Rates clearance and land rent clearance

You must get rates clearance from the county (varies; often a few thousand shillings).

For leasehold land, get a land rent clearance certificate from the landlord or the National Lands Commission (costs vary). (The Realtors Platform | Houses For Sale)

6) Legal (advocate / conveyancing) fees

Typical lawyers’ fees for conveyancing range roughly 1% – 2% of the property value for many firms (some advocates charge a band up to 2–4% depending on the value and work). Always agree fees in writing before you start. (WKA)

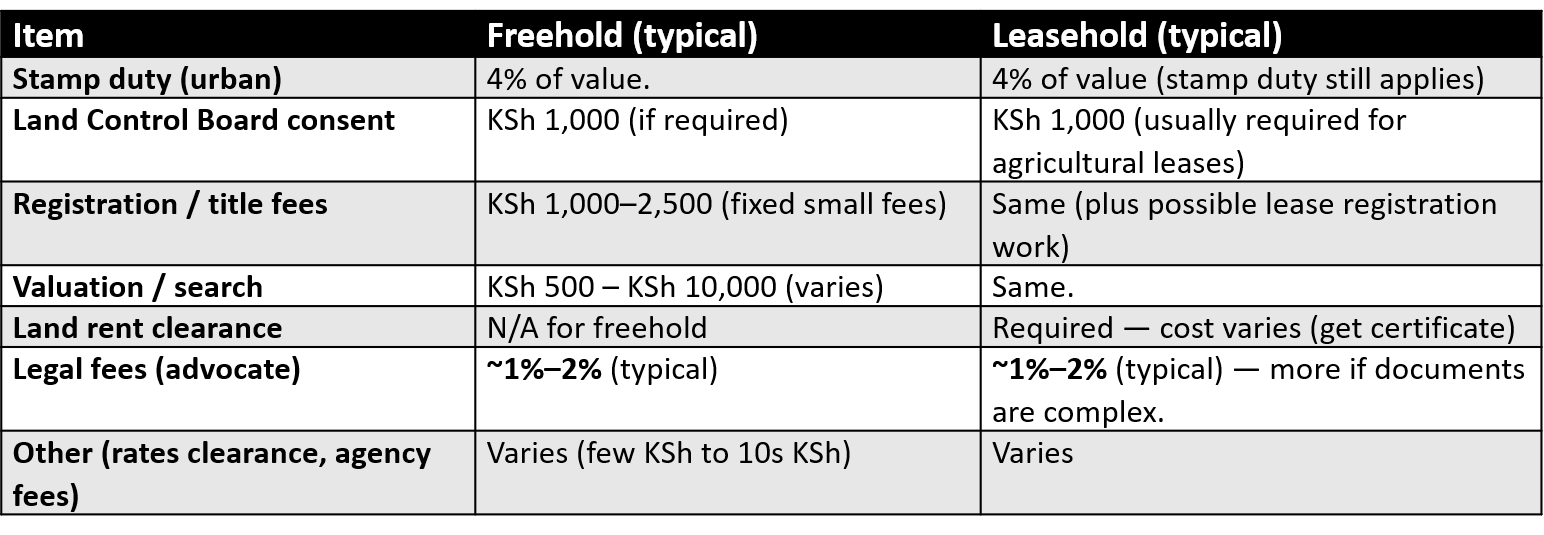

Quick table: Typical fees you will pay (estimates for 2025)

Note: The biggest single cost is usually stamp duty. The rest are small or variable.

Differences: Freehold vs Leasehold (simple)

Freehold: Owner owns the land outright. Transfer needs stamp duty, registration, title handover, searches, rates clearance. (State Department for Lands)

Leasehold: Owner has a lease from the landlord (e.g., government, county). Transfer still pays stamp duty and registration. You also need land rent clearance and sometimes landlord consent or extra lease paperwork. Lease registration steps may take longer. (State Department for Lands)

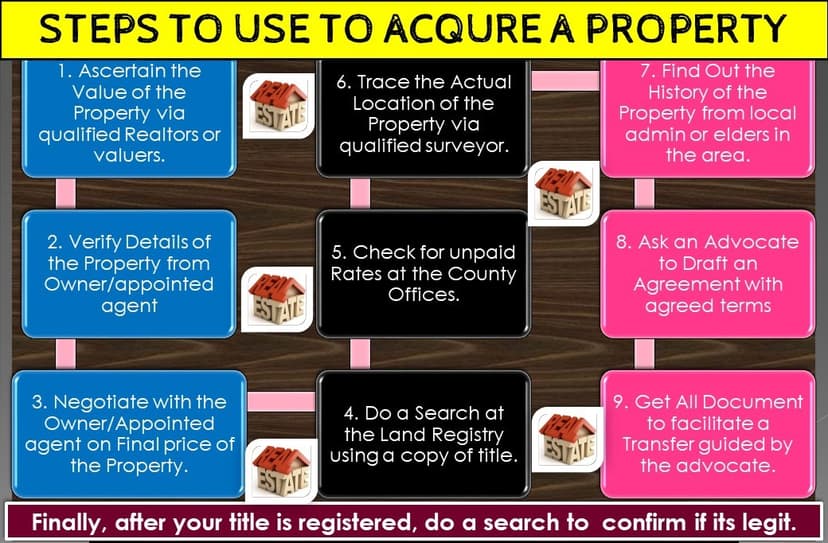

Practical steps to transfer title

Sign sale agreement & pay deposit.

Lawyer prepares transfer documents and gets LCB consent if needed. (State Department for Lands)

Government valuation for stamp duty. Pay stamp duty to KRA. (Kenya Revenue Authority)

Obtain rates clearance and land rent clearance (if leasehold). (The Realtors Platform | Houses For Sale)

Lawyer files transfer at the Lands Registry and pays registration fees. (State Department for Lands)

New title issued in buyer’s name.

Legal charges needed to transfer (summary)

Advocate fees (conveyancing): agree a percentage or fixed fee before work. Typical band: 1%–2% (or according to the Advocates Remuneration Order / firm rates). (WKA)

Disbursements the lawyer will pay for you: title search, valuation, LCB application, KRA stamp duty payment, registration fees, and any county rates clearance. These are billed separately. (State Department for Lands)

Documents the seller must give to help transfer

(Ask the seller to bring these to the lawyer before transfer.)

Original Title Deed (original). (State Department for Lands)

Signed Sale Agreement and Transfer Form (signed). (MMS Advocates)

Land Rent Clearance (if leasehold) or proof of land rent payment. (State Department for Lands)

Rates Clearance Certificate from county (paid up). (The Realtors Platform | Houses For Sale)

Identification — ID or passport and KRA PIN. (State Department for Lands)

Original Documents of title and any powers of attorney used. (MMS Advocates)

Any consents already obtained (e.g., LCB consent if seller applied). (State Department for Lands)

Documents the buyer needs to provide

(So the lawyer can file transfer quickly.)

Buyer’s ID or passport and KRA PIN. (State Department for Lands)

Signed transfer forms where applicable (attorney will prepare). (MMS Advocates)

Proof of payment of stamp duty (KRA receipt) when paid. (Kenya Revenue Authority)

Rates clearance application details (buyer may help obtain). (The Realtors Platform | Houses For Sale)

For companies: CR12, PIN, and company resolution authorising purchase. (MMS Advocates)

Final practical tips (so you don’t get surprised)

Always ask your lawyer to give a cost estimate (itemised) before starting. This should show stamp duty, lawyer fees, searches, and filing fees. (WKA)

If the land is agricultural, expect LCB consent is needed. Start that early (it can take time). (Kenya Law)

Keep copies of all receipts (stamp duty, rates clearance, registration). These are needed to collect your new title. (State Department for Lands)

Rules change sometimes. Before you pay large sums, confirm current rates with KRA and the Lands Registry. (KRA for stamp duty; Lands for registration fees and process). (Kenya Revenue Authority)

Useful official links to learn more;

Kenya Lands — Land transfers & fees (Lands Department). (State Department for Lands)

Kenya Revenue Authority — Stamp Duty info. (Kenya Revenue Authority)

Land Control Board consent rules. (Kenya Law)