Beginner’s Guide: 10 Practical Ways to Start Investing in Real Estate in Kenya (Ranked from Easiest to Most Complex)

Real estate is one of the most trusted and proven wealth-building strategies in Kenya. Whether you are starting with KES 5,000 or you have millions, there is always an entry point.

The biggest challenge for most beginners is knowing where to start, how much is needed, and what options are the safest when you are new.

This guide explains 10 practical and realistic ways to start investing in real estate in Kenya, ranked from easiest → most complex, with realistic starting capital and local examples.

1. Real Estate Investment Trusts (REITs) — Easiest & Lowest Capital

REITs allow you to invest in Kenyan real estate without buying physical property. You simply buy units (like shares) on the Nairobi Securities Exchange.

Why REITs are great for beginners:

Start with very little money

Very passive — no land issues, no construction, no tenants

Easy to buy and sell

How much is needed: KES 5,000–50,000 to buy a few units.

Examples in Kenya:

ILAM Fahari I-REIT (income-focused)

Acorn Student Accommodation REITs (I-REIT & D-REIT)

Where to buy: Through a stockbroker, investment app, or regulated digital investment platforms.

2. Property Unit Trusts / Real-Estate Mutual Funds

These are professionally managed funds that invest in property projects, listed property companies, or rental portfolios.

Why beginners like them:

Low capital

Diversified

Very passive

Start-up capital: KES 5,000–100,000

Examples: ILAM, Stanlib, and other regulated fund managers offer property-focused investment products.

3. Real Estate Crowdfunding Platforms

This is where many investors contribute money to a specific project — like student housing, rentals, or commercial property.

Why it’s popular:

Small entry ticket

You pick specific projects

Higher potential returns than savings accounts

Start-up capital: KES 5,000–200,000 depending on the platform.

Tip:

Always choose CMA-regulated platforms or those working with licensed REIT managers.

4. Fractional Ownership (Shared Ownership of a Property)

This model allows you to buy a percentage of a house or apartment instead of the whole unit.

Why it works:

Access to expensive properties at a lower price

Comes with professional property management

Ideal for student housing, Airbnb units, and serviced apartments

Start-up capital: KES 50,000–500,000+

5. Short-Stay Rentals (Airbnb / Serviced Apartments)

Here, you buy or lease a unit and furnish it for short-term stays.

Why it’s profitable:

Higher daily rates than long-term rentals

Strong demand in Nairobi, Mombasa, Naivasha, and tourist/business hubs

Start-up capital:

KES 200,000–600,000 if you are leasing and furnishing

KES 2.5M–10M+ if you are buying the unit

Tip:

Hire a reliable property manager if you don’t want the day-to-day stress.

6. Buy-to-Let (Long-Term Rentals)

This involves buying property and renting it out long-term — one of the most stable forms of real estate investing.

Why it’s reliable:

Steady rental income

Property appreciates over time

Banks offer mortgages to support buyers

Start-up capital:

KES 1.5M–10M+ depending on the location and deposit

Mortgages usually require 10–20% deposit

Where to invest:

Neighbourhoods near universities, hospitals, business hubs, new transport corridors, or fast-growing satellite towns.

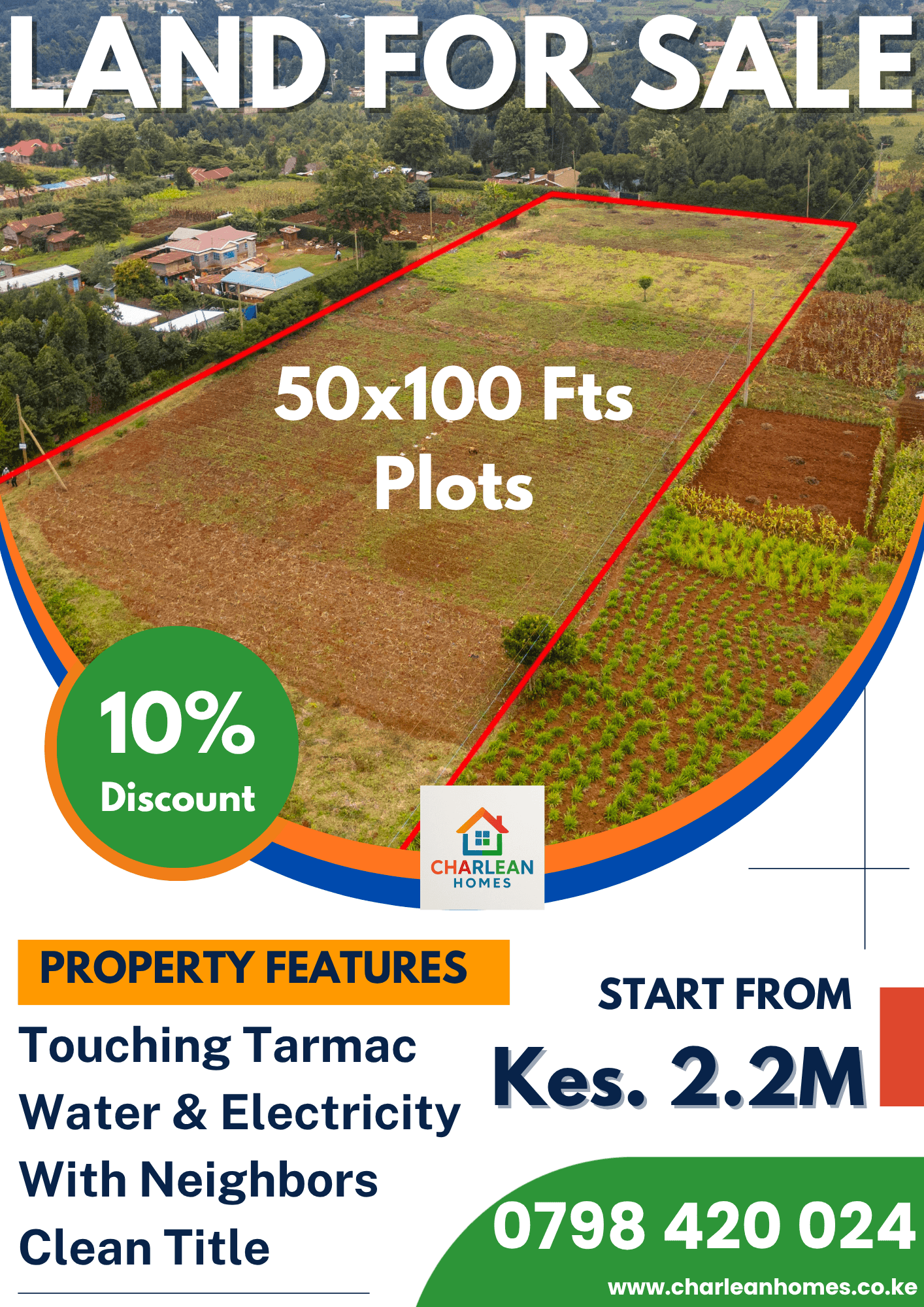

7. Buying Land (Urban & Peri-Urban Plots)

This is the most common entry point in Kenya because land rarely loses value.

Why land is attractive:

Lower entry cost in peri-urban areas

Excellent long-term appreciation

You can build or resell later

Start-up capital:

KES 200,000–1,000,000 in emerging areas

KES 1,000,000–5,000,000+ in fast-growing zones like Limuru, Ruiru, Kitengela, and Juja

Tip:

Carry out full due diligence — title search, ground verification, beaconing, seller background, and zoning.

8. Real-Estate Investment Groups (Chamas, Investment Clubs & Joint Ventures)

A group of people pool funds to buy land, invest in rentals, or develop apartments together.

Why it works:

Share risks and costs

Access larger or better projects

Builds collective investment discipline

Start-up capital: KES 500,000–5,000,000+ per member, depending on the project.

Important:

Always create written agreements on decision-making, withdrawals, profit-sharing, and timelines.

9. Fix-and-Flip (Buy, Renovate, and Sell for Profit)

This involves buying an old or undervalued property, renovating it, and selling it at a higher price.

Why it can be profitable:

Quick capital gains

Increasing demand for upgraded, modern units

Start-up capital:

KES 1.5M–10M+ including renovation costs

Skills required:

Negotiation

Project management

Strong market knowledge

Good contractor network

10. Real Estate Development (Build and Sell) — Most Complex

This is the highest level of real estate investing and involves:

Buying land

Doing architectural designs

Getting approvals

Financing construction

Selling or renting units

Start-up capital:

KES 5M–100M+ depending on the size

Most developers use equity + bank loans + off-plan sales

Why it’s rewarding:

Highest profit margins

Full control over design and pricing

Flexible scaling

Why it’s complex:

Requires experience, professionals, and strong cashflow

Regulatory approvals take time

Construction risk is high

Ranked Summary: Easiest → Most Complex Ways to Invest in Real Estate in Kenya

REITs (KES 5,000–50,000)

Property Unit Trusts (KES 5,000–100,000)

Crowdfunding Platforms (KES 5,000–200,000)

Fractional Ownership (KES 50,000–500,000)

Short-Stay Rentals (Airbnb) (KES 200,000–3M+)

Buy-to-Let (KES 1.5M–10M+)

Buying Land (KES 200,000–5M+)

Investment Groups / Joint Ventures (KES 500,000–5M+)

Fix-and-Flip (KES 1.5M–10M+)

Real Estate Development (KES 5M–100M+)

How to Choose the Best Starting Point (Beginner Tips)

1. Start with low-risk, low-capital options.

REITs and crowdfunding are ideal for learning while your money grows.

2. Build your knowledge.

Learn about titles, zoning, basic due diligence, construction costs, and market trends.

3. Grow slowly and consistently.

Move from REITs → land/ rentals → development as your capital and experience grow.

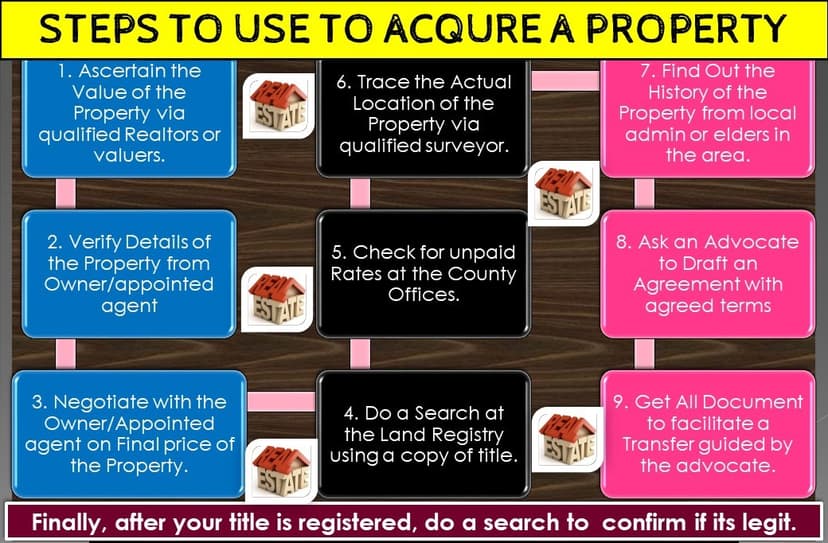

4. Always verify before paying.

Do title searches, confirm approvals, and verify developers on eCitizen and the Lands Registry.

Final Thoughts

Real estate in Kenya offers multiple paths — whether you want fully passive investing or hands-on development. The key is starting with what you can afford today, building experience, and scaling slowly.